Sequential Investment Task (SIT)

| Table of Contents | ||

| Description | ||

| References |

Description:

| Purpose |

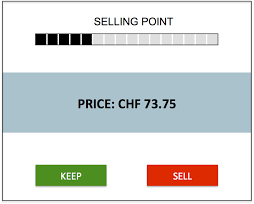

This is a sequential risk-taking task similar to the BART. The task consist of selling shares over the course of

virtual days. In contrast to the BART, the underlying payoff structure is non-monotonic (i.e., in the BART the

payoffs as well as the probability of an explosion monotonically increase across trials). Specifically, the prices

of the shares can repeatedly increase and decrease, which gives rise to a variety of different risk- (and

payoff-) profiles. The SIT can be parameterized on several dimensions and can thus be used to study risk

taking, exploration vs. exploitation trade-offs, learning abilities, as well as overall decision competence.

| |

| Questions |

|

|

| Sub-scales |

The sequential development of the shares' prices can follow different stochastic patterns. We have

implemented the SIT with a uni-modal structure (i.e., a single global maximum) as well as with a bi-modal

structure (i.e., a global as well as a local maximum).

| |

| Domain |

Risk Attitude: Behavioral Measures of Risk

| |

| Sample items |

|

References:

Scale:Frey, R., Rieskamp, J., & Hertwig, R. (2015). Sell in May and go away? Learning and risk taking in nonmonotonic decision problems. Journal of Experimental Psychology: Learning, Memory, and Cognition, 41(1), 193-208. https://doi.org/10.1037/a0038118

Uses:

*