Judgment and Decision Making, Vol. 14, No. 4, July 2019, pp. 513-533

The decision paradoxes motivating Prospect Theory: The prevalence of the paradoxes increases with numerical ability

Philip Millroth*

Håkan Nilsson#

Peter Juslin#

|

Prospect Theory (PT: Kahneman & Tversky, 1979) of risky decision making

is based on psychological phenomena (paradoxes) that motivate assumptions

about how people react to gains and losses, and how they weight outcomes

with probabilities. Recent studies suggest that people’s numeracy affect

their decision making. We therefore conducted a large-scale conceptual

replication of the seminal study by Kahneman and Tversky (1979), where we

targeted participants with larger variability in numeracy. Because people

low in numeracy may be more dependent on anchors in the form of other

judgments we also manipulated design type (within-subject design, vs.

single-stimuli design, where participants assess only one problem). The

results from about 1,800 participants showed that design type had no

effect on the modal choices. The rate of replication of the paradoxes in

Kahneman and Tversky was poor and positively related to the

participants’ numeracy. The Probabilistic Insurance Effect was observed

at all levels of numeracy. The Reflection Effects were not fully

replicated at any numeracy level. The Certainty and Isolation Effects

explained by nonlinear probability weighting were replicated only at high

numeracy. No participant exhibited all 9 paradoxes and more than 50% of

the participants exhibited at most three of the 9 paradoxes. The choices

by the participants with low numeracy were consistent with a shift

towards a cautionary non-compensatory strategy of minimizing the risk of

receiving the worst possible outcome. We discuss the implications for the

psychological assumptions of PT.

Keywords: prospect theory, replication, numeracy, experimental design

1 Introduction

In their seminal article, Kahneman and Tversky (1979) presented

behavioral results from 16 choice problems, designed to demonstrate ways

in which human decision making under risk violates the assumptions of

Expected Utility Theory (EUT). These psychological phenomena –

elevated to “paradoxes” by virtue of their conflict with EUT – were in

turn used to motivate psychological assumptions, principally

in the form of nonlinear reactions to value and probability and

differential reactions to gains and losses of the same magnitude. These

hypothesized mechanisms motivated the functional forms of

Prospect Theory (PT), such as the value and the probability weighting

functions. Although it was based on a relatively small sample, few

studies have had a stronger influence on the field of decision making.

These functional forms have been used to explain behavior in many

domains of the social sciences: for example, labor supply

(Camerer, Babcock, Loewenstein & Thaler, 1997), international

relations (e.g., Jervis, 1992), and conflict theory (e.g., Levy, 1996).

It has been proposed that these functional forms are evolutionary

adaptive (McDermott, Fowler & Smirnow, 2008; Mallpress, Fawcett,

Houston & McNamara, 2015). With time the ability to account

for these phenomena have been hoisted to benchmarks for any model that

is to be allowed into the debate on decision making under risk

(Birnbaum, 1999; 2008, Brandstätter, Gigerenzer & Hertwig, 2006;

Erev, Ert, Plonsky, Cohen & Cohen, 2017).

There are, at least, three different kinds of empirical research that is

performed in connection with PT: i) Studies that attempt to

replicate the psychological phenomena that motivated the original

formulation of PT; ii) Studies that test if the psychological

assumptions postulated by PT are the correct explanations of these

phenomena (e.g., if the so called Certainty Effect, see below, is

explained by the nonlinear probability weighting); iii)

Studies that apply the function forms of PT to account post hoc for

real-life phenomena.

Given the recent discussion of a “replication crisis” in the behavioral

sciences (Nelson, Simmons & Simonsohn, 2018) – and the observation that

relatively few studies on PT have been concerned with replication (but see

notable exceptions in the review presented below) – in this article we

attempt to replicate the psychological phenomena that supported

PT. The replication is conceptual, rather than direct, because it

targets a population with a wider range of numeracy (i.e., the

ability to apply and reason with numerical concepts) than the original

study did (which involved undergraduate university students).

Variation in numeracy was desirable because past research has highlighted

the impact of numeracy on decision making, often finding it to be superior

to general cognitive abilities (e.g., algebra competence, intelligence,

cognitive reflection, literacy) for predicting decision making skills (see

Cokely et al., 2016), and also finding that it has a direct effect on the

functional forms of PT (see more under “Aims and Hypotheses of the Present

Study”). Consequently, a wide range of numeracy enabled a test of the

robustness and limiting conditions of the results presented by Kahneman and

Tversky (1979). Because we previously have shown that people’s probability

weighting functions appear to be dependent on anchors in the form of related

judgments, we also manipulated design type: Within-Subject Design (WSD)

vs. Single-Stimuli Design (SSD) where participants assess only one problem

(Millroth, Nilsson & Juslin, 2018).

1.1 The seminal study by Kahneman and Tversky (1979)

The strategy in Kahneman and Tversky (1979) was to set up pairs of binary

choice problems, where the participants choose between A1

and B1 and A2 and B2. The

pairs were constructed so that choices of A1 and

B2, or B1 and A2, are

incompatible with EUT. A total of 16 problems were included, which together

posited nine paradoxes1: four different variants of

the Certainty Effect; two variants of the Reflection

Effect; two variants of the Isolation Effect; and the

Probabilistic Insurance Effect. The choice problems are

described in Table 1 and explained in the following, along with the results

in the original study. Note that our labeling of Problem 14 and 16

corresponds to “13´ ” and “14´ ” in Kahneman and Tversky (1979).

| Table 1: Summary of items included for analysis along with the response

patterns from Kahneman and Tversky (1979). The proportions within

parentheses in the right-most column of the table show 95 per cent

credible intervals. Plus signs (+) indicate additional information at

the end of the table. |

| Paradox | Problem | Alternative | Prospect Description (outcome, probability) | Majority choice in KT | Proportion of “A” Responses |

| Certainty effect | 1 | A | (2,500, .33); (2,400, .66); (0, .01) | B | .186 (.109; .285) |

| | | B | (2,400) | | |

| | 2 | A’ | (2,500, .33); (0; .67) | A | .827 (.730; 902) |

| | | B’ | (2,400, .34); (0; .66) | | |

| Certainty effect | 3 | A | (4,000; .80); (0, .20) | B | .204 (.132; .292) |

| | | B | (3,000) | | |

| | 4 | A’ | (4,000, .20); (0, .80) | A | .651 (.552; .741) |

| | | B’ | (3,000, .25); (0, .75) | | |

| Certainty effect | 5 | A | 50 to win a three-week tour of three countries+ | B | .227 (.142; .331) |

| | | B | A one week tour of one country with certainty | | |

| | 6 | A’ | .05 to win a three-week tour of three countries | A | .664 (.551; .765) |

| | | B’ | .10 to win a one week tour of one country | | |

| Certainty effect | 7 | A | (6,000, .45); (0, .55) | B | 144 (.074; .240) |

| | | B | (3,000, .90); (0, .10) | | |

| | 8 | A’ | (6,000, .001); (0, .999) | A | .723 (.609; .820) |

| | | B’ | (3,000, .002); (0, .998) | | |

| 21inProbabilistic insurance | 9 | Yes | Would you purchase probabilistic insurance? | No | .204 (.132; .292) |

| | | No | | | |

21inIsolation effect

for probabilities | 10++ | A | (4,000, .80); (.20, 0) | B | .222 (.160; .295) |

| | | B | (3,000) | | |

21inIsolation effect

for outcomes | 11+++ | A | (1,000, .50); (0, .50) | B | .164 (.090; .260) |

| | | B | (500) | | |

| | 12 | A’ | (−1,000, .50); (0, .50) | A | .687 (.573; .788) |

| | | B’ | (−500) | | |

21inReflection effect

for outcomes | 13 | A | (6,000, .25); (0, .75) | B | .183 (.104; .284) |

| | | B | (4,000, .25); (2,000, .25); (0, .50) | | |

| | 14 | A’ | (−6,000, .25); (0, .75) | A | .699 (.582; .801) |

| | | B’ | (−4,000, .25); (−2,000, .25); (0, .50) | | |

21inReflection effect

for probabilities | 15 | A | (5,000, .001); (0, .999) | A | .718 (.609; .812) |

| | | B | (5) | | |

| | 16 | A | (−5,000, .001); (0, .999) | B | .173 (.098; .270) |

| | | B | (−5) | | |

| + England, France, Italy. |

| ++ The item is described as a two-stage

game where choice options A and B occur in stage two IF one wins in

stage one (pwin in stage 1 = .75). The choice

between A and B must be made before stage one. |

| +++ For item 11[12] choices are supposed

to be made under the following condition: “In addition to whatever you

own, you have been given 1000[2000]”. Thus, the ultimate outcomes are

the same for A and A’, and for B and B’. |

1.2 The certainty effect

To exemplify the certainty effect, consider the first problem in the

second pair (Problem 3 in Table 1) that involved a choice between a

lotteries with a .80 probability of winning $4000 (A) or $3000 for

certain (B). The other problem in the pair (Problem 4 in Table 1)

involved a choice between two lotteries, one with a .20 probability of

winning $4000 (A’) and one with a .25 probability of winning $3000

(B’). Notably, in the light of EUT, both of these problems involve a

choice between prospects with expected utility

p•u($3000) and

.8p•u($4000) (p is the

probability, and u() is a utility function). Because EUT

assumes a linear use of probability, it postulates that a person who

prefers A [B] should also prefer A’ [B’]. This holds for all stable

utility functions. In conflict with EUT, the majority response in

Kahneman and Tversky (1979) was to choose B and A’. This result,

together with the similar demonstrations comparing Problems 1 and 2,

Problems 5 and 6 and Problems 7 and 8, suggest that people’s subjective

weighting of probabilities is nonlinear. Most notably, as shown in the

first three comparisons, people prefer outcomes that are certain. In

addition, later studies have shown that for probabilities other than 0

or 1, people tend to overweight the low and underweight the high

probabilities (e.g., Tversky & Kahneman, 1992).

1.3 The isolation effects

These demonstrations show that prospects can be decomposed into common

and distinctive components in more than one way, and that different

decompositions can lead to inconsistent preferences. For example,

consider Problems 4 (described above) and 10. Problem 10 involves two

compound, or two-stage, lotteries. Under both lotteries, there is a .75

probability of losing in the first stage. However, if one

proceeds to the second stage, then lottery A offers a .8 probability of

winning $4000 while lottery B gives $3000 for certain. Thus, the

amounts that can be won and the probabilities of winning are identical

in Problems 4 and 10. Despite this, as shown in Table 1, the majority

response differed greatly between the two problems. The comparisons

between Problems 4 and 10 and Problems 11 and 12 show two ways in which

different descriptions of one and the same choice problem might give

rise to contradictory choices. In the first comparison, one option is

made attractive by associating it with a certain positive outcome. As

for the first three comparisons in Table 1, this result highlights an

apparent attractiveness of perceived certainty (i.e., of perceived

control and predictability). In the second comparison, one option is

made unattractive by framing it as if it involved a certain loss. PT

implies that this framing effect occurs because people have different

value functions for gains and losses.

1.4 The reflection effects

These effects posit that outcomes are treated differently in the loss and

the gain domain. For example, Problems 13 and 14 are identical apart from

one involving only gains and the other only losses.

1.5 Probabilistic insurance

A probabilistic insurance is a hypothetical insurance described as

follows. If you have a probabilistic insurance against event E (e.g., your

house burns down) and E occurs, then there is a probability of p that all

your expenses are paid. However, there is also a probability of 1−p that

your premium is returned and that you receive no coverage. In Problem 9,

participants are asked if they would be interested in a probabilistic

insurance that costs half the full premium but has a .5 probability of not

covering any costs. Because of the standard assumption in EUT of a concave

utility function, .5 × u(2X) > u(X), and people should prefer a

probabilistic to a deterministic insurance. As shown in Table 1, only 20%

responded that they would be interested in such an option. Research has

shown that it is primarily due to an overweighing of rare events (Wakker,

Thaler & Tversky, 1997).

1.6 Explanatory mechanisms

The paradoxes in Kahneman and Tversky (1979) can roughly be divided into

three categories, according to what psychological assumptions they evoke

for their explanation. In analogy with many findings in perception and

psychophysics, the psychological assumptions typically imply better

discrimination between stimuli close to salient references, the current

state of wealth in regard to the value functions and certain states in

regard to the probability weighting function (see also Tversky & Kahneman,

1992).

Problems 1–9 (the Certainty and the Probabilistic Insurance Effects),

and the comparison of Problem 10 to Problem 4 (the Isolation Effect for

probabilities) all relate to the non-linearity of probability

weighting, where there is especially acute discrimination between

probabilities close to 0 and 1, and over-weighting of low probabilities

and under-weighting of high probabilities (Tversky & Kahneman, 1992).

However, there is also evidence suggesting that subjective probability

is categorical (Fleming, Maloney & Daw, 2013); that probabilities of

0 (impossible) and 1 (certain) are particularly vivid and treated

qualitatively different from other categories. Notably, this is fully

in line with the Certainty Effect. The second category of

demonstrations includes demonstrations attributed to the shape

of the value function with the most acute discrimination close to the

current state of wealth, implying a convex value function for losses

and a concave value function for gains (Problems 11–12). The third

category of demonstrations includes effects attributed to

loss-aversion: the differential evaluation of magnitudes in

the loss and gain domain (Problems 13–14, 15–16).

1.7 Conceptual replication attempts

For choices, evidence for the paradoxes in Kahneman and Tversky (1979) is

mixed. In a recent study with university students, the Certainty Effect and

the Reflection Effects were replicated (Erev et al., 2017, see Kühberger,

Schulte-Mecklenbeck & Perner, 1999 & Linde & Vis, 2017 for similar

results). But other studies show that the prevalence of the Certainty and

the Reflection Effects decrease if other presentation formats than

explicitly stated probabilities are used (Carlin, 1990; Erev & Wallsten,

1993). The effects are also sensitive to the population tested. Politicians

in a study did not exhibit the effects (Linde & Vis, 2017) and the effects

decreased in people high in both education and domain knowledge (Huck &

Müller, 2012). Moreover, several studies have failed to capture the

Isolation Effect for Outcomes (see Romanus & Gärling, 1999) and shown that

the differences in curvature between utility and probability functions in

the loss- and gain domains are fairly small (Harbaugh, Krause &

Vesterlund, 2009; Mukherjee, Sahay, Pammi & Srinivasan, 2017; Yechiam &

Hochman, 2013); the main difference being that an outcome is perceived as

more extreme in the loss than the gain domain. However, also the existence

of this hypothesized loss aversion has been questioned (e.g., Harbaugh et

al., 2009; Nilsson, Rieskamp & Wagenmakers, 2011). The endowment effect

that is typically explained by the notion of loss aversion, has likewise

been questioned (Plott & Zeifler, 2005).

In sum, the probability weighting seems highly dependent on context and

cognitive constraints of the decision maker (Fox & Poldrack, 2014) and the

paradoxes related to loss aversion and curvature differences for gains and

losses seem to be most difficult to replicate. Intriguingly, although PT

was originally formulated for choices, the evidence for the paradoxes is,

if anything, stronger with evaluations of prospects (e.g., certainty

equivalents or willingness-to-pay). For example, the fourfold-pattern of

risk attitudes (risk seeking over low-probability gains; risk-averse over

high probability gains; risk-averse over low-probability losses;

risk-seeking over high-probability losses) seems more prevalent under

evaluations (Harbaugh et al., 2009).

1.8 Aims and Hypotheses of the Present Study

The aim of the study is a conceptual replication of Kahneman and Tversky

(1979), engaging a participant population with a wider range of numeracy

than in the original study (to be precise, the higher levels of numeracy in

our study should approximate the levels of numeracy in the original

study).2 At

first glance, the literature might suggest that the less numerate should be

more vulnerable to the paradoxes. For example, the less numerate are more

incoherent in probability judgments (Liberali et al., 2012; Lindskog et

al., 2015; Winman et al., 2014) and their probability weighting functions

are more nonlinear and sensitive to framing (Millroth & Juslin, 2015;

Patalano, Saltiel, Machlin & Barth, 2015; Schley & Peters, 2014; Traczyk

& Fulawka, 2016). A more nonlinear probability weighting function will

produce more of the paradoxes reported in Kahneman and

Tversky3.

However, the studies documenting that probability weighting is dependent on

numeracy have relied on evaluations of risky prospects. It is

well-established that preferences can differ depending on whether

preferences are elicited through evaluations of prospects or by

choices between prospects (Lichtenstein & Slovic, 2006) – the

latter being the method used by Kahneman and Tversky (1979). Studies on

choices between risky prospects suggest that people often do not rely on

the compensatory strategy implied by PT, where trade-offs are made between

probabilities and value (Cokely & Kelley, 2009, Reyna, Chick, Corbin &

Hsia, 2014). Instead people often rely on non-compensatory heuristics, for

example, choosing the option that minimizes the risk of obtaining the worst

possible outcome, and such heuristics are especially likely to be used by

people that are low in numeracy (Cokely & Kelley, 2009). It may thus be

those high in numeracy that are most affected by the by the paradoxes

implied by the nonlinear and compensatory processing of value and

probability implied by PT.

The issue of whether cognitive illusions arise both in within-subject and

between-subject designs (WSDs, BSDs) has been repeatedly addressed

(Kahneman & Frederick, 2005) and people often disclose more normative

behavior in a WSD (e.g., Regenwatter, Dana & Davis-Stober, 2011; Tversky,

1969; Mellers, Weiss & Birnbaum, 1992). Specifically, recent research

suggests that the presence of comparative anchors in a WSD allow people to

produce more linear probability weighting than in an extreme case of the

BSD, namely the Single-Subject Design (SSD, where participant make only one

judgment in isolation, Millroth et al., 2018). This predicts larger

Certainty Effects and Isolation Effects for Probability – effects explained

by the nonlinear probability weighting function – in a SSD.

Kahneman and Tversky (1979) focused on reporting choice proportions and

modal responses (i.e., showing that while a majority chose B for the first

problem, a majority chose A’ for the second problem). However, in recent

years it has become increasingly clear that inferences about the behavior

of individuals from aggregate data can be problematic (e.g., Kirman, 1992;

Jouini & Napp, 2012; Regenwetter et al., 2009; Regenwetter, Dana &

Davis-Stober, 2011; Regenwetter & Robinson, 2017). Indeed, for the first

paradox, Kahneman and Tversky (1979) reported not only choice proportions

and modal choice for each problem (i.e., 82% choose Option B in Problem 1

and 83% choose option A’ in Problem 2), but also the proportion of

individuals actually producing the paradoxical choice pattern (i.e., 61%

of the individuals made this EUT-violating choice pattern, BA’, see p.

266). For the other paradoxes they did not, leaving the reader to assume

that the same pattern held for the other paradoxes. In this article, we

therefore report not only the modal choice and the choice proportions

(e.g., 60% of the participants choose B in Problem 1), but also the

proportion of participants that disclose the paradoxical choice pattern

(e.g., 20% revealed the choice pattern B and A’ for Problems 1 and 2

violating EUT). Note that 60% choosing B and 60% choosing A’ is

consistent with 80% of the individuals making choices in agreement with

EUT.

2 Method

2.1 Participants

In the main study, the WSD sample consisted of 346 participants (165 male

and 181 female participants) ranging in age from 18 to 75 years (M

= 36.9, SD = 12.4). The SSD sample consisted of 1,287 participants (576

male and 711 female) ranging in age from 18 to 74 years (M = 34.9,

SD = 12.3).4 Settings on the platform CrowdFlower.com were set so

that participants were residents in the U.S. Collection of data continued

until the recruitment rate plateaued (i.e., when it was one week’s time

since any new participants had started the survey). The participants were

compensated with one U.S. dollars for the SSD and a quarter dollar for the

SSD.

A potential disadvantage of recruiting participants online is less

experimental control over responses, possibly with poorer data quality

as a result, although the empirical evidence for this claim is weak at

best (Gosling & Mason, 2015; Hauser & Schwarz, 2016). We address this

concern with a number of separate analyses presented at the end of the

Results section.

2.2 Design, Material & Procedure

The experiment involved all the 16 forced-choice problems in Table 1. All

choices were hypothetical. We created four surveys with different

presentation orders5 to control for the possibility that the results were

driven by a specific presentation order. Each participant in the WSD was

randomly assigned to one of the surveys, resulting in 88 participants

allocated to Survey A; 86 participants allocated to Survey B; 90

participants allocated to Survey C; and 82 participants allocated to Survey

D.6 Before

starting the survey, the participants reported their age and gender. They

received written information that the study addressed judgment and decision

making, was not in any way invasive or unpleasant, did not involve

deception, and that part taking was voluntary. The participants were

explicitly told that they could abort the study whenever they wished. No

personal information was recorded in a way that could make identification

of a specific participant possible.

Numeracy was measured last with the four-item Berlin Numeracy Test (BNT;

Cokeley et al., 2012). While there are other tests of numeracy (e.g.,

Schwartz, Woloshin, Black & Welch, 1997; Lipkus, Samsa & Rimer, 2001),

the BNT has come to be the most widely-used test validated for use with

diverse samples from industrialized communities, doubling the predictive

power of the best available alternative numeracy instruments, uniquely

predicting decision quality independent of several measures of general

cognitive abilities (Cokely et al., 2018; Ghazal et al., 2014; Lindskog,

Kerimi, Winman & Juslin, 2015). As LimeSurvey (the survey tool that we

used) allows for the collection of response times, these were also

collected. An example screen-shot of the decision task is available at

https://osf.io/fjvmz/.

2.3 Statistical Analyses

Analyses conducted involved Bayesian Hypothesis Testing (BHT) using the

Bayes Factor (BF) in the software JASP (JASP Team, 2018: v. 0.8.6) and

Bayes Factor Package in R (Morey, Rouder & Jamil, 2015: v. 0.9.2+: for a

discussion of the advantages of BHT over Null-Significance Hypothesis

Testing, NSHT, see Dienes, 2014; 2017; Rouder, Speckman, Sun, Morey &

Iverson, 2009; Wagenmakers, 2007). Bayes factors (BFs) focus on the

relative evidence, provided by the data, for the hypotheses (NHST focus on

the probability of the data, given that a null hypothesis is true). BFs

thus indicate how many times more likely the data are under one hypothesis

compared to under another hypothesis (e.g., BF10 = 100

represents that the data are 100 times more likely under Hypothesis 1 than

under Hypothesis 0). Throughout the results section, however, we

demonstrate that the conclusions obtained are not contingent on the use of

BHT, but correspond to the conclusions suggested by NHST (p-values).

3 Results

A Bayesian ANOVA based on the WSD with number of EUT-violations (1–9) as

dependent variable and presentation order as independent variable did not

yield any evidence that the presentation order affected the number of

effects (BF10 = .110), and these datasets were thus

collapsed to one single WSD set. We first compared the choice proportions

and modal responses for each problem in the WSD sample and the SSD

sample. Then we compared our results with those reported by Kahneman and

Tversky (1979). Then we asked whether numeracy affected the prevalence of

decision paradoxes in our data. Finally, we did complementary analyses in

order to check our conclusions

3.1 WSD vs. SSD

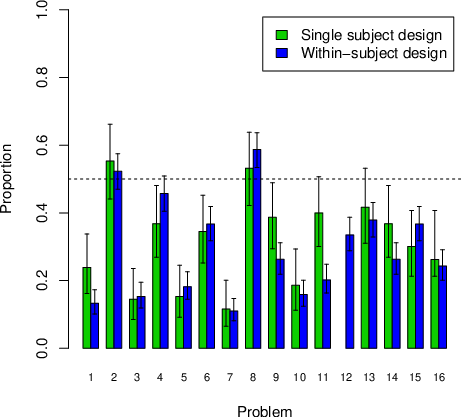

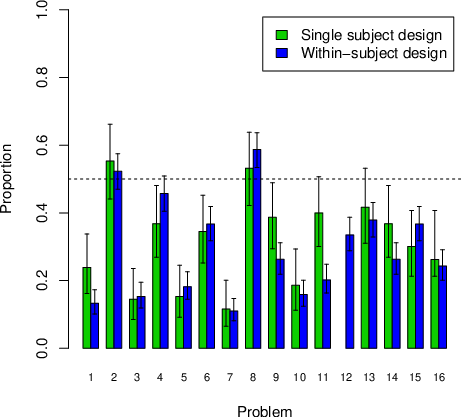

Figure A1 in Appendix A report the mean proportions “Decision A” with

95% credible intervals, for data from the SSD and the WSD (the

proportions are summarized in Tables A1 in Appendix A together with

Bayesian hypothesis tests). Figure A1 suggests that for most problems

the decision proportions are similar in both designs. The only

exception is Problem 11, where there is a higher proportion of Decision

A in the SSD than in the WSD. For no problem is the modal decision

changed by the design and we conclude that there is little evidence for

large or systematic effects of the design.

| Table 2: Proportion of “A” (“Yes” for item 9) responses for all 16 items

of the present study (parentheses show lower and upper 95% credible

intervals), along with three Bayes factors (BFs). BF10 quantifies the

evidence against the population proportion being .5. BFDir quantifies

the evidence in favor of the population proportion being in the

observed direction as opposed to the other direction. BFDiff quantifies

the evidence against the choice proportions in the relevant choice

problems being the same in the population. Instances where the

corresponding p-value was above .05 is denoted with an asterisk (*). |

| Effect | Problem | Choice Proportion | BF10 against .50 | Majority

Choice | BFDir | BFDiff |

| Certainty effect | 1 | .154 (.123; .191) | > 1000 | B | >1000 | >1000 |

| | 2 | .530 (.482; .577) | .129* | A | 7.9 | |

| Certainty effect | 3 | .152 (.121; .189) | >1000 | B | >1000 | >1000 |

| | 4 | .441 (.394; .488) | .140* | B | 130 | |

| Certainty effect | 5 | .176 (.143; .215) | >1000 | B | >1000 | >1000 |

| | 6 | .363 (.319; .409) | >1000 | B | >1000 | |

| CertaintyeEffect | 7 | .111 (.085; .144) | >1000 | B | >1000 | >1000 |

| | 8 | .576 (.529; .623) | 8.85 | A | >1000 | |

| Probabilistic insurance | 9 | .289 (.249; .333) | >1000 | No | >1000 | |

| Isolation effect for probabilities | 10 | .163 (.131; .202.) | >1000 | B | >1000 | >1000 |

| Isolation effect for outcomes | 11 | .241 (.203; .284) | >1000 | B | >1000 | 4.51 |

| | 12 | .335 (.288; .387) | >1000 | B | >1000 | |

| Reflection effect for outcomes | 13 | .385 (.340; .433) | >1000 | B | >1000 | 9.32 |

| | 14 | .282 (.241; .327) | >1000 | B | >1000 | |

| Reflection effect for probabilities | 15 | .354 (.311; .401) | >1000 | B | >1000 | 23.1 |

| | 16 | .246 (.206; .289) | >1000 | B | >1000 | |

3.2 Comparison with Kahneman and Tversky (1979)

Because there were no differences in the majority choices in the WSD and

SSD, we collapsed the two datasets in order to gain statistical power when

the aggregated proportions were compared with the proportions reported in

Kahneman and Tversky (1979).7 The results are

reported in Table 2 and visually compared to Kahneman and Tversky (1979) in

Figure 1. In the statistical analysis, we report three different Bayes

Factors (BFs): BF10 quantifies the evidence in favor of a

population proportion different from .5 relative to the evidence that this

proportion is .5 (roughly corresponding to a two-tailed t-test

with NSHT). BFDir quantifies the evidence that the

population difference is in the observed direction relative to in the

alternative direction (i.e., that the population proportion is

> .5 if the sample proportion is >.5, and

correspondingly for a negative difference).8 BFDiff quantifies the evidence in favor of a

difference between the two choice proportions that together define the

paradox.9

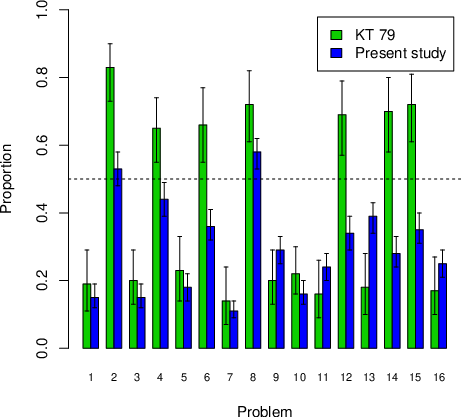

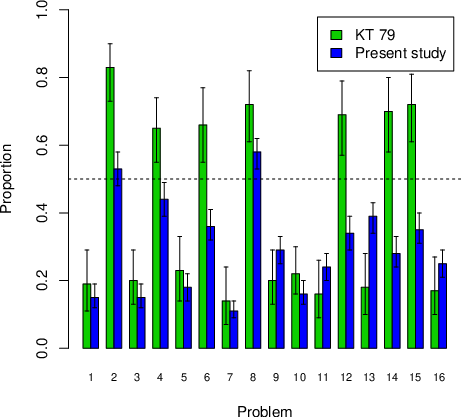

| Figure 1: Proportion of ”A”-answers for the 16 problems in Kahneman and

Tversky (1979) and the present study. Proportions above .50 means that

the modal response was “A”; below means that the modal response was

“B”. Horizontal bars illustrate 95% credible intervals. |

3.3 Choice proportions and modal responses

In Table 2 we see that, as in Kahneman and Tversky (1979), for most

problems there is clear evidence against the null-hypothesis that the

population proportion is .5 (BF10 > 1000:

the exceptions are Problems 2, 4, 8) and for most paradoxes there is

evidence against the choice proportions in the two problems compared

being the same. However, it is only for 11 of the 16 problems that we

replicate the modal response in Kahneman and Tversky. Among these 11

problems, the evidence actually favors H0 (a population

proportion of .5) over H1 for Problem 2 (choice

proportion .530; BF10 = .129) and the evidence for

H1 is weak for Problem 8 (choice proportion .576;

BF10 = 8.85). For the cases where the modal response in

the attempted replication deviates from the original study, the

evidence is very strong (Problems 4, 6, 12, 14, & 15).

As a consequence, in terms of the nine paradoxes, in Kahneman and

Tversky (1979) reported in terms of conflicting modal choices, it is

only for two out of the nine paradoxes (the Certainty Effects with .001

probabilities and the Probabilistic Insurance Effect) that we

unambiguously replicate the modal pattern (e.g., “B” for Problem 1 and

“A’” for Problem 2). As illustrated in Figure 1, there appear to be

systematic differences between our results and those reported by

Kahneman and Tversky, with much more “B” choices in our data. “B” choices

all involve choice of a certain outcome (and are therefore risk averse)

except for Problems 7, 8, 13, and 14, three of which were exceptions to

strong preference for B relative to Kahneman and Tversky.

3.4 Paradoxes at the individual level

Examining the proportion of individuals in the WSD that showed 0, 1,… up

to all 9 paradoxes in Kahneman and Tversky (1979) (i.e., either producing a

EUT-violating AB’ or BA’ choice patterns for the pair of problems), it is

clear that not a single participant (N = 346) produced all nine

paradoxes, the modal participant produced 2 of the 9 paradoxes, and the

median participant produced 3 paradoxes, suggesting that more than 50 % of

the participants exhibited no more than 3 of the 9 original paradoxes (the

patterns of replicated paradoxes are discussed in greater detail in the

next section on the effects of numeracy, and they are summarized in

Appendix B).

3.5 Dependence on Numeracy

3.5.1 Choice proportions and modal responses

Tables C1 to C5 in Appendix C report results for each numeracy group (zero

to four items correct on the BNT) in the same fashion as in Table 2. We

generally replicate the finding that the choice proportions

differ. However, as summarized in Figure 2 (see also Table B1 in Appendix

B), there are notable differences regarding the modal patterns across

numeracy groups. First, the number of modal-pattern replications increase

systematically as the numeracy increases (Table 3). Second, the increases in

modal-pattern replications are related to the paradoxes driven by the

probability weighting function. Third, for the “paradoxes” linked to the

value and the loss function the modal pattern was EUT-consistent choices,

if only because subjects were generally risk averse. When the modal patterns

were not replicated, it was generally not because data yielded insufficient

evidence, but rather because they favored other patterns than in the

original study (e.g., “B” and “B” instead of “B” and “A”). In sum, the modal

results in Kahneman and Tversky (1979) are not replicated for all numeracy

levels and best replicated for the probability-weighting paradoxes and the

most numerate participants.

| Table 3: Replication of the modal response patterns dependent on the

number of items correct on the BNT. “R” illustrate that the statistical

evidence was in favor of replication, minus-sign (“-“) illustrate that

the statistical evidence was in favor of another modal pattern (e.g.,

“B” and “B” instead of “B” and “A”), and “r” illustrate that the

evidence could not decide between the two possibilities. |

| Paradox | Items correct on the BNT |

| | 0 | 1 | 2 | 3 | 4 |

| Certainty effect 1 | - | R | R | R | R |

| Certainty effect 2 | - | r | r | R | R |

| Certainty effect 3 | - | - | r | - | R |

| Certainty effect 4 | - | R | R | R | R |

| Probabilistic insurance | R | R | R | R | R |

| Isolation effect (probabilities) | - | - | - | - | R |

| Isolation effect (outcomes) | - | - | - | - | - |

| Reflection effect for outcomes | - | - | - | - | - |

| Reflection effect (outcomes) | - | - | - | - | - |

| N: | 685 | 508 | 280 | 123 | 37 |

| Table 4: Summary of the patterns of replication of the nine paradoxes in

Kahneman and Tversky (1979) at the level of the individual participant

as a function of numeracy (0 to 4 correct answers on the BNT), together

with indication of the main explanation postulated by Prospect Theory,

either in terms of the value function (VF) or the probability weighting

function (PW). The percentage entries in the table is the percentage of

participants in each category for which the paradox was replicated. For

ease of identification, those categories where the majority of

participants exhibited the paradox are denoted with an asterisk (*). |

| | Explanation | Items correct on the BNT | |

| Paradoxes | VF | PW | 0 | 1 | 2 | 3 | 4 | All |

| Certainty effect 1 | | X | 39% | 44% | 48% | 56% | 75%* | 45% |

| Certainty effect 2 | | X | 27% | 41% | 44% | 44% | 75%* | 38% |

| Certainty effect 3 | | X | 22% | 20% | 37% | 32% | 63%* | 27% |

| Certainty effect 4 | | X | 42% | 57%* | 52%* | 65%* | 88%* | 51%* |

| Probabilistic insurance | | X | 69%* | 74%* | 84%* | 71%* | 63%* | 74%* |

| Isolation effect for probabilities | | X | 28% | 44% | 40% | 41% | 75%* | 38% |

| Isolation effect for outcomes | X | | 22% | 35% | 16% | 32% | 0% | 25% |

| Reflection effect for outcomes | X | | 13% | 16% | 15% | 24% | 25% | 16% |

| Reflection effect for probabilities | X | | 25% | 30% | 33% | 35% | 25% | 29% |

| Average proportion of revealed paradoxes | 32% | 40% | 41% | 44% | 54%* | 38% |

| Average proportion for PW | 38% | 47% | 51%* | 52%* | 73%* | 46% |

| Average proportion for VF | 20% | 27% | 21% | 30% | 17% | 23% |

| Samples sizes N | 130 | 99 | 75 | 24 | 8 | 346 |

3.5.2 Paradoxes at the individual level

A Bayesian ANOVA with number of paradoxes as dependent variable and

numeracy group as the independent variable (parametric assumptions were

satisfied) yielded a BF10 of 52.6 (strong evidence) in

favor of a difference between the numeracy groups (p

< .05; see also Appendix D).

The descriptive statistics summarized in Table 4 strongly suggest that

the observed difference between the numeracy groups is limited to

the paradoxes associated with the probability weighting function. Among

the paradoxes linked to the probability weighting, the EUT-inconsistent

choice pattern was the modal pattern for Numeracy Groups 3, 4, and 5

(for 51%, 52%, and 74% of the participants in each group,

respectively). For “paradoxes” linked to the value function, the

paradoxical choice pattern in Kahneman and Tversky (1979) was never the

most typical pattern (on average observed in 23% of the participants).

Supporting these notions, tests of linear trends using

logistic-regression analysis for each paradox with prevalence of

paradox (yes/no) as the dependent variable and BNT-score as an

independent variable (coded on an interval level) showed significant

effects for Certainty effect 1–4 and the Isolation effect for

probabilities.10

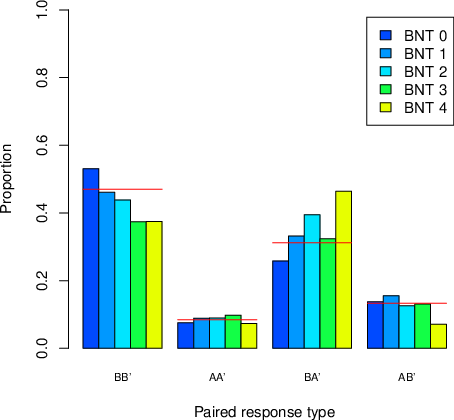

Importantly, the pattern at the level of the individuals (Table 4) is

very similar to the pattern observed for the modal response proportions

(Figure 2). The prevalence of paradoxes is dependent on numeracy.

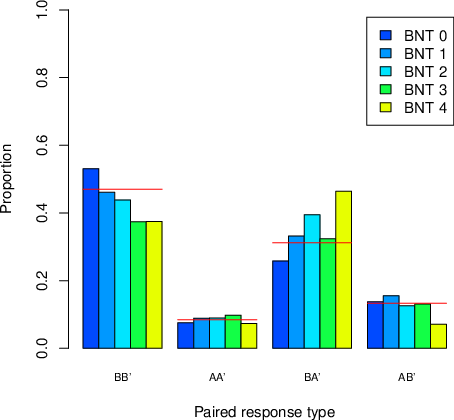

Figure 2 (Table B2 in Appendix B) show that (i) BB’ was the

most prevalent choice pattern, with increasing frequency as numeracy

decreases; (ii) BA’ choices (which were the choice pattern

emphasized by Kahneman & Tversky, 1979) were the second-most prevalent

pattern with increasing frequency as numeracy increases;

(iii) AA’ responses was the most rare pattern, and with no

visible difference between the numeracy groups; (iv) AB’

responses were the second-most rare pattern, also with no visible

difference between the numeracy groups. This finding is worth

stressing: the difference in the responses is due to how the

participants respond to BB’ or BA’. Notably, B’ as compared to A’, are

options that minimize the risk of obtaining the worst possible outcome,

corresponding to the notion that the less numerate rely on heuristics

that favor less risky options (Cokely & Kelley, 2009), while the more

numerate integrate more of the quantitative information (Reyna et al.,

2014).

| Figure 2: The proportion of paired responses (y-axis), for each numeracy

group and for all participants (lines), for each paired response type

(x-axis). |

3.5.3 Adressing data quality and noise as a confounding variable

A concern may be that the data for the less numerate participants may be of

lower quality because they, for example, are less motivated to engage in

numerical choice tasks (e.g., Peer, Samat, Brandimart & Acquisti,

2016). Several lines of evidence speak against this interpretation. First,

BNT is seemingly not correlated with measures of motivation (Cokely et al.,

2012). Second, the responses for the least numerate deviate systematically

from .5 and do not seem random or arbitrary. For example, inspecting the

choice proportions for each of the 16 choice problems for the least

numerate (Table B1 in Appendix B), we see that the evidence for a choice

proportion different from .5, over the .5 null-hypothesis of decision

proportion .5 (i.e., random choice), is supported by a BF10

> 1000 for 13 of the 16 problems. The same conclusion is

suggested by the consistent choice pattern by the least numerate in Figure

4, which deviates most distinctly from the uniform distribution expected by

chance responses. The low replication rate at low numeracy is not a result

of more random responses.

Third, there was no evidence that the response times differed between

the BNT groups: a Bayesian ANOVA, with the lognormal-transformed

average response times per prospect as the dependent variable, and BNT

group as the independent variable, yielded a BF10 of

.072 (p>.05); and for the response times for the

BNT test the ANOVA yielded a BF10 of .122

(p>.05).11 It thus

seems unlikely that the less numerate simply wanted to get through the

experiment as quickly as possible and collect their payment. It should

also be noted that our sample also replicated the same positive skew of

responses on the BNT that previous research has documented for similar

crowd source-recruited participants (Cokely et al., 2012); thus, there

was seemingly nothing peculiar with our participants compared to other

similar data samples.

Fourth, assuming that the probability weighting and value functions can

be used to model peoples’ behavior, less reliable responses (i.e., more

“noisy” responses”) should lead to more of the patterns

observed by Kahneman and Tversky (1979), not less: That random noise

contributes to a more nonlinear probability weighting function (and

thus should produce more paradoxes) has been demonstrated elsewhere

(Blavatsky, 2007; Millroth et al., 2018).

A more serious potential problem motivated an independent replication of

our results. Following how we (wrongly) interpreted that Kahneman and

Tversky (1979) conducted their study, we did not counter-balance the

presentation order of the alternatives (i.e., the prospects for

Alternative A, the first choice option, was the same for all

participants). Hypothetically, some of the results reported in Table 2

could be driven by a large proportion of participants having chosen

Alternative B because it was always presented on the right-hand side of

the screen. We therefore conducted an independent replication of the

results in Table 2, where half of the participants received the options

in the same order as in Table 2 (N = 99) and the other half

received the items in the reverse order (N = 100; see Table 4

for results).

In contrast to the hypothesis of a response bias towards Option B (e.g.,

because it is on the right on the computer screen), the response

proportions in Table E1 in Appendix E are mirror images of each other

when the choice options are reversed (i.e., if alternative A was

majority response in the original order, Alternative B was majority

response in the reverse order). The BFDiff in favor of

a difference in the proportions between the two order conditions in

Table 4 were low and ranged between .177 and .466 over the 16 problems

(and between .261 and 1.66, if we only consider the participants with

the lowest numeracy, BNT = 0). Thus, regardless of the presentation of

the choice options, the results in Table E1 replicate the results in

Table 2, but here three out of the nine modal patterns in Kahneman and

Tversky (1979) reappear.12

The consistent mirror effect of reversing the order of the decision

options in Table E1 provides further evidence that the responses

collected here – and by implication the relatively modest replication

rate – are not explained by the participants providing random

responses.

A Bayesian between-subjects ANOVA provides evidence (a

BF10 = 34.3, p <.05) for a

difference in the number of paradoxes between the numeracy groups, with

most replicated paradoxes for participants with highest numeracy (M =

4.75, SD = 2.06) and the lowest number of replicated paradoxes

for participants with lowest numeracy (M = 2.43, SD = 1.52).

In these data, no participant (N = 199) exhibited all 9

paradoxes in the original study.

4 Discussion

The aim of this study was to provide a conceptual replication of the

psychological effects that were reported in the classical study of

Kahneman and Tversky (1979), relating the results to the numeracy of

the participants and the role of contextual support in terms of other

related judgments (raised in terms of the comparison between a WSD and

an SSD). These psychological effects – or decision paradoxes – have in

turn been used to motivate a number of psychological assumptions of PT,

essentially nonlinear probability weighting, nonlinear value functions

that are differently shaped for gains and losses, and an stronger

reaction to losses than to gains of the same magnitude (i.e., loss

aversion). Because we found no strong evidence for systematic

differences in the choice proportions depending on the design type, the

subsequent discussion is focused on the observed differences between

the present study and Kahneman and Tversky (1979) and on how the

results are related to numeracy.

4.1 Replication of the paradoxes in Kahneman and Tversky (1979)

While we replicate that the choice proportions often differ between the two

choice-problems that define a paradox, the results show that for the entire

participant sample the modal responses were clearly replicated only for two

of the nine paradoxes (one Certainty Effect and Probabilistic

Insurance). The conflicting modal choices in these paradoxes were in focus

in Kahneman and Tversky (1979), because they suggested that a majority of

the individuals produced choices that are incompatible with EUT. In our

results, this seems to be most evident for the paradoxes that are related

to the probability weighting function and among the most numerate

participants.13 14 The paradoxes associated with the value function and

loss aversion were harder to replicate in our study. Not a single

individual exhibited all 9 paradoxes posited by PT, and over 50 percent of

all participants exhibited no more than three of the paradoxes. These

conclusions tie into at least two lines of previous research.

First, the prevalence of the reflection effects has indeed varied across

studies (e.g., Ert & Erev, 2013; Harbaugh et al., 2009; Nilsson,

Rieskamp & Wagenmakers, 2011; Yechiam & Hochmann, 2013). The same is

true also for the Isolation Effect for Outcomes (Romanus & Gärling,

1999) and even the Certainty Effect has been shown to depend on the

presentation format (Carlin, 1990; Harbaugh et al., 2009) and the

participant population (Linde & Vis, 2017; Huck & Müller, 2012).

Tellingly, the studies that have most consistently replicated the

original results (Erev et al., 2017; Kühberger et al., 1999) have used

participants recruited from universities; participant that are likely

to exhibit high scores on numeracy.

Second, concerns related to ‘generalized agent models’ (Kirman, 1992)

deserve more attention. For a number of reasons, Kahneman and Tversky

(1979), along with later studies focusing on choice proportions at the

aggregate level, may have over-stated the case for the degree to which

the individual participants disclose the choice patterns that

correspond to the nine paradoxes. Kirman (1992) argued that i)

there may simply be no direct relation between individual and

collective behavior, ii) the generalized agent need not react

to a manipulation in the same manner as the underlying individuals, and

iii), the beliefs by the generalized agent may not be shared

by any of the individuals, but emerges due to the effects of

dispersion. Recent research has shown by simulations that this may hold

for the psychological assumptions of PT (e.g., Jouini & Napp, 2012;

Regenwetter & Robinson, 2017).

The point is not to argue that PT is poorer than EUT as a quantitative

account of the data. By contrast, because PT is more flexible with free

parameters (with EUT as special case) it will trivially be better at

accounting for various patterns observed in data, including those

observed here and those implied by EUT. The ability of a model to

capture also various more idiosyncratic patterns present in a minority

of the participants can be regarded as a virtue of a quantitative

model. Therefore, PT may in many applied circumstances be a more valid

and versatile instrument to describe a variety of different choice

patterns than EUT.

However, the results presented here do raise questions about how

universal the assumptions postulated by PT are and highlight the

importance of determining their limiting conditions. The results in

Kahneman and Tversky (1979) served to motivate and illustrate the key

assumptions of PT, which were intended – as far as we can tell – to

capture important and general aspects of human decision making that

deviate from the assumptions of EUT. It is thus hard to regard the

limited replicability of these phenomena in a wider population as

anything but potentially problematic. As noted above, relaxing EUT in

ways that take psychological assumptions into account can be useful to

capture choice behaviors. The results presented here, however, raise

the question of whether the assumptions made in PT are the most

relevant ones for capturing prevalent deviations from EUT. Moreover,

the application of PT to explain many large-scale societal phenomena

that apparently represent deviations from EUT often seems to presume

that the weighting functions of PT are operative in many or most of the

individual agents. The validity of these assumptions and their

associated effects may also be dependent on the individual

characteristics of the agent, such as his or her level of numeracy. Our

results also question if the account of these paradoxes should be

obligatory benchmarks that any theory of risky decision making in the

field should meet.

4.2 Dependence on numeracy

As noted in the Introduction, the previous literature on numeracy suggested

two contrasting possibilities regarding the outcome of the present

study. The first possibility was that the less numerate would exhibit more

paradoxes because they have a probability-weighting function that is more

nonlinear than the more numerate (Millroth & Juslin, 2015; Patalano et

al., 2015; Schley & Peters, 2014; Traczyk & Fulawka, 2016), and in the

current context a more nonlinear probability weighting function will render

more paradoxes. However, a second possibility pointed to the notion that

the larger observed nonlinearity of the probability weighting function for

lower numeracy has been observed for evaluations of prospects. When people

make choices between prospects, however, the less numerate have been found

to rely on simple heuristics that often favor less risky options (Cokely &

Kelley, 2009), while the numerate are capable of more deliberate behavior,

taking the quantitative details of the problems into account (Cokely &

Kelley, 2009; Reyna et al., 2014).

The results showed that the least numerate exhibited the fewest

paradoxes at the individual level, and the most numerate exhibited most

paradoxes at the individual level. The differences was constrained to

the paradoxes that relate to the probability weighting function

proposed by Kahneman and Tversky (1979; see also Tversky and Kahneman,

1992). Most of the effects of numeracy were consistent with a

systematic shift in the less numerate to a more cautious

non-compensatory strategy that minimized the risk of obtaining the

worst possible outcome, in line with the second possibility. The simple

strategy of rejecting the option with the poorest possible outcome or,

if all options have this same poorest outcome as a possibility, to

reject the option with the higher probability of this poor outcome,

predicts Option B for all choice problems in Table 1, which corresponds

to the decision behavior at low numeracy (see Table C1 in Appendix C).

Researchers therefore need to be aware of the implications: the

preferences captured in any given experiment is likely to depend on an

interaction between the type of elicitation method (evaluations vs.

choices) and level of numeracy. This is in line with a growing body of

research that has documented the malleability of preferences derived

from behavioral measures (e.g., Pedroni et al., 2017): rather than

having stable risk preferences that can be fundamentally different

between people, it seems that people are instead probably equipped with

a large variety of decision strategies that they apply in response to

the specific architecture of the environment.

We found no evidence that these patterns were explained by “random

responses” or poor data quality. The responses provided at low numeracy

seem highly systematic and when the order of the choice options are

reversed, so are the choice between the alternatives (i.e., if the

participants choose Option A in the original order they seem to select

Option B when the options are presented in the reverse order). Neither

were there differences in the response times to the prospects, nor to

the BNT. Future research could usefully include other measures of

numeracy (e.g., the Lipkus-test), measures of motivation and of

metacognition, in order to elucidate the exact mechanisms by which the

differences numeracy causes the result.

4.3 Why is numeracy positively related to the susceptibility to

(some) paradoxes?

In the following, we entertain two (not necessarily exclusive)

explanations. A first explanation emphasizes that the kind of

lottery-metaphor tasks typically used in decision research (and in this

study) may be cognitively more demanding to people with low numeracy.

People low in numeracy may therefore find it especially difficult to

confidently evaluate these complex quantitative options and instead

they may retreat to the more cautious strategy of minimizing the risk

of receiving the worst possible outcome, the pattern observed in our

data.

On the one hand, this attitude makes some sense (i.e., even those high

in numeracy could presumably be presented with lottery options that are

so complex that they are difficult to evaluate, which they therefore

are inclined to reject ) and in regard to the specific choice set in

Kahneman and Tversky (1979) it leads to better agreement with EUT. On

the other hand, and in the large scheme of things, inability to

properly integrate probabilities and outcomes to identify superior

options will often produce mediocre decisions with poorer long-term

accrual of returns. This can be considered as an epistemic risk

aversion, where people avoid not only the options where the outcome

obtained is unknown, but also the options for which they lack

sufficient confidence in their own ability to accurately evaluate their

attractiveness. Future research should delineate to what extent this

holds under varying conditions (i.e., numerically simplifying things in

terms of attributes and alternatives),

A second potential explanation is provided by fuzzy-trace theory (FTT:

Brainers & Reyna, 1990; Reyna & Brainerd, 1995; Reyna, 2008; Reyna &

Brainerd, 2011; Broniatowski & Reyna, 2018). FTT posits that people rely

on two types of mental representations: verbatim and gist

representations. Verbatim representations capture the exact surface form of

problems or situations, how they are perceived literally (e.g., the words

or numbers). Gist captures the bottom-line meaning of the problem or

situation. In contrast to verbatim representations, which are precise (and

quantitative, if they involve numbers), gist representations are vague and

qualitative. People are capable of processing both verbatim and gist

information, but they prefer to reason with gist traces rather than

verbatim. Importantly, FTT can explain the functional forms of probability

and value posited by PT (for the mathematics, see Reyna & Brainerd, 2011;

Broniatowski & Reyna, 2018). A hypothesis in the framework of FFT is that,

in choices between risky prospects, the least numerate rely on

gist-representations while the more numerate are more able to make use of

verbatim quantitative representations.

4.4 Conclusions

We believe that our study demonstrates that i) the replication

rate for the paradoxes in Kahneman and Tversky(1979) that originally

motivated the key psychological assumptions of PT is very modest in a

population with a larger variation in numeracy; ii) The

paradoxes that are easiest to replicate are those that relate to the

probability weighting function, but they primarily occur among

participants that are high numeracy; and iii) The choices in

people low in numeracy make are consistent with a shift towards a more

cautious and non-compensatory strategy that concentrates on minimizing

the risk of obtaining the worst outcome. The results highlight

important limiting conditions for the psychological assumptions made in

PT.

References

Birnbaum, M. H. (1999). Paradoxes of Allais, stochastic dominance, and

decision weights. Decision science and technology: Reflections

on the contributions of Ward Edwards, 27–52.

Birnbaum, M. H. (2008). New paradoxes of risky decision

making. Psychological Review, 115(2), 463–501.

Reyna, V. F., & Brainerd, C. J. (1995). Fuzzy-trace theory: Some

foundational issues. Learning and Individual

differences, 7(2), 145–162.

Brandstätter, E., Gigerenzer, G., & Hertwig, R. (2006). The priority

heuristic: making choices without trade-offs. Psychological

Review, 113(2), 409–432.

Broniatowski, D. A., & Reyna, V. F. (2018). A Formal Model of

Fuzzy-Trace Theory: Variations on Framing Effects and the Allais

Paradox. Decision, 5(4), 205–252.

Camerer, C. F., Dreber, A., Forsell, E., Ho, T. H., Huber, J.,

Johannesson, M., ... & Heikensten, E. (2016). Evaluating replicability

of laboratory experiments in

economics. Science, 351(6280), 1433–1436.

Camerer, C., Babcock, L., Loewenstein, G., & Thaler, R. (1997). Labor

supply of New York City cabdrivers: One day at a time. The

Quarterly Journal of Economics, 112(2), 407–441.

Carlin, P. S. (1990). Is the Allais paradox robust to a seemingly

trivial change of frame?. Economics Letters, 34(3),

241–244.

Cokely, E. T., & Kelley, C. M. (2009). Cognitive abilities and superior

decision making under risk: A protocol analysis and process model

evaluation. Judgment and Decision Making, 4(1), 20–33.

Cokely, E. T., Feltz, A., Ghazal, S., Allan, J. N., Petrova, D., & Garcia-Retamero, R. (2017). Decision making skill:

From intelligence to numeracy and expertise. Cambridge Handbook of

Expertise and Expert Performance, 2nd, Cambridge University Press, New

York NY.

Cokely, E. T., Galesic, M., Schulz, E., Ghazal, S., & Garcia-Retamero,

R. (2012). Measuring risk literacy: The Berlin numeracy

test. Judgment and Decision Making, 7(1), 25–47.

Dienes, Z. (2014). Using Bayes to get the most out of non-significant

results. Frontiers in Psychology, 5, Article ID 781.

Erev, I., Ert, E., Plonsky, O., Cohen, D., & Cohen, O. (2017). From

anomalies to forecasts: Toward a descriptive model of decisions under

risk, under ambiguity, and from experience. Psychological

Review, 124(4), 369–409.

Erev, I., & Wallsten, T. S. (1993). The effect of explicit

probabilities on decision weights and on the reflection

effect. Journal of Behavioral Decision Making, 6(4), 221–241.

Fennema, H., & Wakker, P. (1997). Original and cumulative prospect

theory: A discussion of empirical differences. Journal of

Behavioral Decision Making, 10(1), 53–64.

Fleming, S. M., Maloney, L. T., & Daw, N. D. (2013). The irrationality

of categorical perception. Journal of Neuroscience, 33(49),

19060–19070.

Fox, C. R., & Poldrack, R. A. (2009). Prospect theory and the brain.

In Glimcher, P.W., & Fehr, E. (Eds). Neuroeconomics: Decision

making and the brain (pp. 145–173). Academic Press. New York.

Ghazal, S., Cokely, E. T., & Garcia-Retamero, R. (2014). Predicting

biases in very highly educated samples: Numeracy and

metacognition. Judgment and Decision Making, 9(1), 15–34.

Gigerenzer, G. (2017). A theory integration

program. Decision, 4(3), 133–145.

Gosling, S. D., & Mason, W. (2015). Internet research in

psychology. Annual Review of Psychology, 66, 877–902.

Grawitch, M. J., & Munz, D. C. (2004). Are your data nonindependent? A

practical guide to evaluating nonindependence and within-group

agreement. Understanding Statistics, 3(4), 231–257.

Harbaugh, W. T., Krause, K., & Vesterlund, L. (2010). The fourfold

pattern of risk attitudes in choice and pricing tasks. The

Economic Journal, 120(545), 595–611.

Hauser, D. J., & Schwarz, N. (2016). Attentive Turkers: MTurk

participants perform better on online attention checks than do subject

pool participants. Behavior Research Methods, 48(1), 400–407.

Huck, S., & Müller, W. (2012). Allais for all: Revisiting the paradox

in a large representative sample. Journal of Risk and

Uncertainty, 44(3), 261–293.

Jervis, R. (1992). Political implications of loss

aversion. Political Psychology, 187–204.

Jouini, E., & Napp, C. (2012). Behavioral biases and the representative

agent. Theory and Decision, 73(1), 97–123.

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of

Decision under Risk. Econometrica, 47(2), 263–292.

Kahneman, D., & Frederick, S. (2005). A model of heuristic

judgment. The Cambridge handbook of thinking and reasoning,

267–293.

Kirman, A. P. (1992). Whom or what does the representative individual

represent?. The Journal of Economic Perspectives, 6(2),

117–136.

Kühberger, A., Schulte-Mecklenbeck, M., & Perner, J. (1999). The

effects of framing, reflection, probability, and payoff on risk

preference in choice tasks. Organizational Behavior and Human

Decision Processes, 78(3), 204–231.

Levy, J. S. (1996). Loss aversion, framing, and bargaining: The

implications of prospect theory for international

conflict. International Political Science Review, 17(2),

179–195.

Lichtenstein, S., & Slovic, P. (Eds.). (2006). The construction

of preference. Cambridge University Press.

Lilienfeld, S. O., & Waldman, I. D. (Eds.).

(2017). Psychological science under scrutiny: Recent challenges

and proposed solutions. John Wiley & Sons.

Linde, J., & Vis, B. (2017). Do politicians take risks like the rest of

us? An experimental test of prospect theory under

MPs. Political Psychology, 38(1), 101–117.

Lindskog, M., Kerimi, N., Winman, A., & Juslin, P. (2015). A Swedish

validation of the Berlin numeracy test. Scandinavian Journal of

Psychology, 56(2), 132–139.

Lipkus, I. M., Samsa, G., & Rimer, B. K. (2001). General performance on

a numeracy scale among highly educated samples. Medical

Decision Making, 21(1), 37–44.

Låg, T., Bauger, L., Lindberg, M., & Friborg, O. (2014). The role of

numeracy and intelligence in health-risk estimation and medical data

interpretation. Journal of Behavioral Decision Making, 27(2),

95–108.

Mallpress, D. E., Fawcett, T. W., Houston, A. I., & McNamara, J. M.

(2015). Risk attitudes in a changing environment: An evolutionary model

of the fourfold pattern of risk preferences. Psychological

Review, 122(2), 364–375.

McDermott, R., Fowler, J. H., & Smirnov, O. (2008). On the evolutionary

origin of prospect theory preferences. The Journal of

Politics, 70(2), 335–350.

Millroth, P., & Juslin, P. (2015). Prospect evaluation as a function of

numeracy and probability denominator. Cognition, 138, 1–9.

Millroth, P., Nilsson, H., & Juslin, P. (2018). Examining the integrity

of evaluations of risky prospects using a single-stimuli design.

Decision, 5(4), 362–377.

Morey, R. D., Rouder, J. N., & Jamil, T. (2015). BayesFactor:

Computation of Bayes factors for common designs. R package version

0.9, 9.

Morey, R. D., & Rouder, J. N. (2011). Bayes factor approaches for

testing interval null hypotheses. Psychological

Methods, 16(4), 406–419.

Mukherjee, S., Sahay, A., Pammi, V. C., & Srinivasan, N. (2017). Is

loss-aversion magnitude-dependent? Measuring prospective affective

judgments regarding gains and losses. Judgment and Decision

Making, 12(1), 81–89.

Nilsson, H., Rieskamp, J., & Wagenmakers, E. J. (2011). Hierarchical

Bayesian parameter estimation for cumulative prospect

theory. Journal of Mathematical Psychology, 55(1), 84–93.

Obrecht, N. A., Chapman, G. B., & Gelman, R. (2009). An encounter

frequency account of how experience affects likelihood

estimation. Memory & Cognition, 37(5), 632–643.

Open Science Collaboration. (2015). Estimating the reproducibility of

psychological science. Science, 349(6251), aac4716.

Pachur, T., & Galesic, M. (2013). Strategy selection in risky choice:

The impact of numeracy, affect, and cross-cultural

differences. Journal of Behavioral Decision Making, 26(3),

260–271.

Patalano, A. L., Saltiel, J. R., Machlin, L., & Barth, H. (2015). The

role of numeracy and approximate number system acuity in predicting

value and probability distortion. Psychonomic Bulletin & Review, 22(6), 1820–1829.

Pedroni, A., Frey, R., Bruhin, A., Dutilh, G., Hertwig, R., & Rieskamp,

J. (2017). The risk elicitation puzzle. Nature Human

Behaviour, 1(11), 803–809.

Peer, E., Samat, S., Brandimarte, L., & Acquisti, A. (2016). Beyond the

Turk: An empirical comparison of alternative platforms for

crowdsourcing online behavioral research.

https://www.ssrn.com/abstract=2594183

Peters, E., Baker, D. P., Dieckmann, N. F., Leon, J., & Collins, J.

(2010). Explaining the effect of education on health: A field study in

Ghana. Psychological Science, 21(10), 1369–1376.

Peters, E., & Bjalkebring, P. (2015). Multiple numeric competencies:

When a number is not just a number. Journal of

Personality and Social Psychology, 108(5), 802–822.

Peters, E., Västfjäll, D., Slovic, P., Mertz, C. K., Mazzocco, K., &

Dickert, S. (2006). Numeracy and decision making. Psychological

Science, 17(5), 407–413.

Regenwetter, M., Dana, J., & Davis-Stober, C. P. (2011). Transitivity

of preferences. Psychological Review, 118(1), 42–56.

Regenwetter, M., Grofman, B., Popova, A., Messner, W., Davis-Stober, C.

P., & Cavagnaro, D. R. (2009). Behavioural social choice: a status

report. Philosophical Transactions of the Royal Society of

London B: Biological Sciences, 364(1518), 833–843.

Regenwetter, M., & Robinson, M. M. (2017). The construct–behavior gap

in behavioral decision research: A challenge beyond

replicability. Psychological Review, 124(5), 533–550.

Reyna, V. F. (2008). A theory of medical decision making and health:

fuzzy trace theory. Medical Decision Making, 28(6), 850–865.

Reyna, V. F., & Brainerd, C. J. (1995). Fuzzy-trace theory: An interim

synthesis. Learning and Individual Differences, 7(1), 1–75.

Reyna, V. F., & Brainerd, C. J. (2011). Dual processes in decision

making and developmental neuroscience: A fuzzy-trace

model. Developmental Review, 31(2), 180–206.

Reyna, V. F., & Brainerd, C. J. (2008). Numeracy, ratio bias, and

denominator neglect in judgments of risk and

probability. Learning and Individual Differences, 18(1),

89–107.

Reyna, V. F., Chick, C. F., Corbin, J. C., & Hsia, A. N. (2014).

Developmental reversals in risky decision making: Intelligence agents

show larger decision biases than college

students. Psychological Science, 25(1), 76–84.

Reyna, V. F., Nelson, W. L., Han, P. K., & Dieckmann, N. F. (2009). How

numeracy influences risk comprehension and medical decision

making. Psychological Bulletin, 135(6), 943–973.

Romanus, J., & Gärling, T. (1999). Do changes in decision weights

account for effects of prior outcomes on risky decisions?. Acta

Psychologica, 101(1), 69–78.

Rouder, J. N., Speckman, P. L., Sun, D., Morey, R. D., & Iverson, G.

(2009). Bayesian t tests for accepting and rejecting the null

hypothesis. Psychonomic Bulletin & Review, 16(2), 225–237.

Schley, D. R., & Peters, E. (2014). Assessing “economic value”

symbolic-number mappings predict risky and riskless

valuations. Psychological Science, 25(3), 753–761.

Schwartz, L. M., Woloshin, S., Black, W. C., & Welch, H. G. (1997). The

role of numeracy in understanding the benefit of screening

mammography. Annals of Internal Medicine, 127(11), 966–972.

Segal, U. (1988). Probabilistic insurance and anticipated

utility. Journal of Risk and Insurance, 287–297.

Shaffer, J. P. (1972). Directional statistical hypotheses and

comparisons among means. Psychological Bulletin, 77(3), 195–197.

Smith, E. R., & Semin, G. R. (2007). Situated social

cognition. Current Directions in Psychological Science, 16(3),

132–135.

Traczyk, J., & Fulawka, K. (2016). Numeracy moderates the influence of

task-irrelevant affect on probability

weighting. Cognition, 151, 37–41.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory:

Cumulative representation of uncertainty. Journal of Risk and

Uncertainty, 5(4), 297–323.

Wagenmakers, E. J. (2007). A practical solution to the pervasive

problems of p values. Psychonomic Bulletin & Review, 14(5),

779–804.

Wakker, P., Thaler, R., & Tversky, A. (1997). Probabilistic

insurance. Journal of Risk and Uncertainty, 15(1), 7–28.

Winman, A., Juslin, P., Lindskog, M., Nilsson, H., & Kerimi, N. (2014).

The role of ANS acuity and numeracy for the calibration and the

coherence of subjective probability judgments. Frontiers in

Psychology, 5, Article ID 851.

Yechiam, E., & Hochman, G. (2013). Losses as modulators of attention:

review and analysis of the unique effects of losses over

gains. Psychological Bulletin, 139(2), 497–518.

Yeh, W., & Barsalou, L. W. (2006). The situated nature of

concepts. The American Journal of Psychology, 349–384.

Zynda, L. (1996). Coherence as an ideal of

rationality. Synthese, 109(2), 175–216.

5 Appendix A: Detailed Report of Statistics Related to Design

(WSD or SSD)

To determine whether the modal responses differed between the samples,

proportions along with 95 per cent credible intervals were derived using

Bayesian binomial tests. To quantify the evidence that a proportion was

either mostly “A” or mostly “B” we calculated a Bayes factor (BF) for each

problem that tested the contrasts that the proportion of answer “A” was

below .50 or over .50. This BF is obtained by first computing a Bayesian

binomial test for a positive difference vs. a point null-hypothesis of

zero difference to obtain a first BF and then computing a Bayesian binomial

test for a negative difference vs. a point null-hypothesis of zero

difference to obtain as second BF. The BF directly contrasting a positive

vs. a negative difference is obtained by taking the ratio of the BFs for

the positive and negative difference. The proportion was categorized as A

or B if the BF was over three, as this at least can be considered “positive

evidence” (Kass & Raftery, 1996). The results are summarized in Table A1,

showing that the modal responses were the same for both samples.

Table A1: Proportion of “A” (Yes for item 9) responses for all 16 items

dependent on design (WSD or SSD) along with BFs quantifying the

evidence that proportion is over/under .50. Proportions within

parentheses show lower and upper 95% credible intervals.

| Prob. | WSD proportions | BF | SSD proportions | BF |

| 1 | .133 (.101; .173) | >103 | .239 (.162; .338) | >103 |

| 2 | .523 (470; .575) | 4.13 | .562 (.441; .662) | 4.61 |

| 3 | .153 (.119; .195) | >103 | .145 (.085; .236) | >103 |

| 4 | .457 (.405; .509) | 17.9 | .368 (.269; .481) | 90.6 |

| 5 | .182 (.145; .226) | >103 | .153 (.092; .245) | >103 |

| 6 | .367 (.318; .419) | >103 | .345 (.252; .452) | 439 |

| 7 | .110 (.081; .147) | >103 | .116 (.065; .201) | >103 |

| 8 | .587 (.534; .637) | >103 | .532 (.422; .638) | 2.48* |

| 9 | .263 (.219; .312) | >103 | .387 (.294; .489) | 66 |

| 10 | .159 (.124; .201) | >103 | .186 (.112; 293) | >103 |

| 11 | .202 (.163; .248) | >103 | .400 (.301; .507) | 29.5 |

| 12 | .335 (.288; .387) | >103 | Missing | |

| 13 | .379 (.329; .431) | >103 | .417 (.310; .532) | 11.51 |

| 14 | .263 (.219; .312) | >103 | .368 (.269; .481) | 90.6 |

| 15 | .367 (.318; .419) | >103 | .301 (.213; .407) | >103 |

| 16 | .243 (201; .291) | >103 | .262 (.213; .407) | >103 |

Figure A1: The mean proportions “Decision A” with 95% credible

intervals for the 16 decisions problems summarized in Table 1 observed

in the present experiment, separately for the data from the Single

Subject Design (SSD) and the Within-Subject Design (WSD).

6 Appendix B: Proportion of Paradoxes

Table B1 report the proportion of participants, for each numeracy group

and for all participants, which exhibited a specific number of

paradoxes. Table B2 report the proportion of responses, for each

numeracy group and for all participants, for each observed

paired-response type.

Table B1: The proportion of participants that exhibited a specific

number of paradoxes for each numeracy group and for all participants in

the WSD.

| | Number of Paradoxes |

| Group | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| O on BNT | .077 | .162 | .238 | .215 | .092 | .115 | .069 | .023 | .008 | .000 |

| 1 on BNT | .020 | .141 | .202 | .141 | .121 | .162 | .131 | .071 | .010 | .000 |

| 2 on BNT | .000 | .213 | .133 | .120 | .147 | .160 | .133 | .080 | .013 | .000 |

| 3 on BNT | .000 | .088 | .147 | .088 | .412 | .059 | .088 | .059 | .059 | .000 |

| 4 on BNT | .000 | .000 | .125 | .125 | .125 | .125 | .375 | .125 | .000 | .000 |

| All participants | .035 | .156 | .194 | .159 | .145 | .133 | .110 | .055 | .014 | .000 |

Table B2: The proportion of responses, for each numeracy group and for

all participants, for each observed paired-response type in the WSD.

| | Paired-Response Type |

| Group | BB’ | AA’ | BA’ | AB’ |

| O on BNT | .534 | .069 | .241 | .156 |

| 1 on BNT | .436 | .096 | .298 | .170 |

| 2 on BNT | .458 | .092 | .290 | .160 |

| 3 on BNT | .371 | .088 | .353 | .188 |

| 4 on BNT | .359 | .078 | .406 | .156 |

| All participants | .469 | .084 | .283 | .164 |

7 Appendix C: Results for Each Numeracy Group

Table C1 to C5 summarize the detailed results for each numeracy group.